One attractive feature of the card is its built-in travel and purchase protections, which can help save you money if things go awry. You can earn a great signup bonus when you get the card. Not only does the Chase Sapphire Reserve charge no foreign transaction fees, it’s also one of the best travel cards on the market. If you’re looking for a card that doesn’t charge foreign transaction fees, you’re likely someone who’s on the road and out of the country quite a bit. You’ll also get up to $100 in statement credits for Global Entry or TSA PreCheck® every four years. The Chase Sapphire Reserve has a $550 annual fee, which is largely offset if you claim the card’s $300 annual travel credit. You can also earn a 60,000-point early spending bonus for using your card for $4,000 in purchases over your first 3 months. If you spend your points on travel using the Chase travel portal, you’ll receive a 50% bonus on each point. Earn 3 points on all other travel and when you dine at restaurants worldwide (including takeout and eligible delivery services), and receive 1 point per dollar spent on everything else. Cardholders earn 5x total points on air travel and 10x total points on car rentals and hotels when purchased through Chase Ultimate Rewards immediately after you spend the first $300 on travel purchases annually. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices.The Chase Sapphire Reserve is our top pick among credit cards that boast no foreign transaction fees. The privacy practices of those third parties may differ from those of Chime.

#FOREIGN TRANSACTION FEE FULL#

See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.īy clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere. Please see back of your Card for its issuing bank. and may be used everywhere Visa credit cards are accepted.

#FOREIGN TRANSACTION FEE LICENSE#

The Chime Visa® Credit Builder Card is issued by Stride Bank pursuant to a license from Visa U.S.A. and may be used everywhere Visa debit cards are accepted. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Because there’s a possibility that a merchant will use an unfavorable exchange rate to maximize their profits, “Dynamic Currency Conversion” is not advised.īanking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Some merchants will ask if you want to be given the cost in USD on their end through a process called ‘Dynamic Currency Conversion’. The FX is added after the conversion to USD. Both Visa and MasterCard calculate exchange rates to convert all transactions in foreign currencies to USD properly. When you get your credit card statement, the actual cost of your dinner will show a charge of $200 + (0.01 x 200) + (0.02 x 200) = $206.ĭon’t forget that exchange rates are a factor in dealing with foreign transactions. Then, the credit card’s issuing bank will charge another 2% on top of that. First, the Visa foreign transaction fee will add 1% to the cost of your dinner. Let’s say that you go out for dinner in Paris and pay $200 using a credit card on the Visa network. The easiest way to understand the process is to look at a sample transaction. or by making a purchase that goes through a foreign bank.

What You Should Know About Foreign Transaction Feesįoreign transaction fees can add up if you spend enough while traveling outside the U.S.

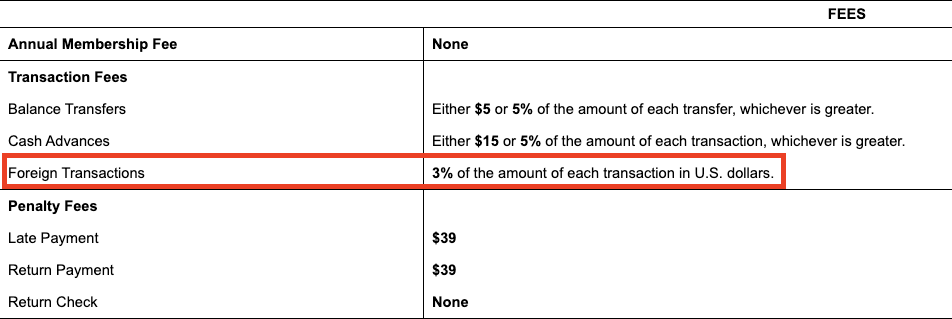

Some banks will absorb the network’s fee so that there’s no cost to you. Then, card-issuing banks might add on their own charges, usually an additional 1 or 2 percent, leaving total foreign transaction fees at 2 or 3 percent depending on the card and issuer. Visa and Mastercard, which handle the transactions between foreign vendors or banks and US card issuers, generally charge a 1% fee for each f oreign transaction. The overall fee is often made up of two fees: One from the payment networks and one from the card’s issuing bank. A foreign transaction fee is also charged on purchases made in a currency other than the US dollar (USD), or that pass through a foreign bank. A foreign transaction fee, sometimes referred to as an FX fee, is assessed by your credit card issuer and is usually charged as a percentage of the purchase that you’re making, 3% is the most common foreign transaction fee.

0 kommentar(er)

0 kommentar(er)