What is the ticker symbol for Volkswagen?

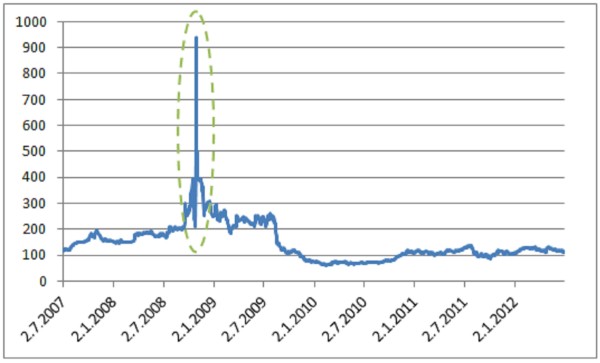

Why is VW stock a good short candidate?ĭespite the financial chaos, Volkswagen announced several quarters with better-than-expected results. In short - it's a great game with fast price moves, random hedge fund chicks and a lot of potential. In short (no pun intended), a short squeeze is when a stock increases its price aggressively, causing sellers to reduce losses and closing positions, inadvertently increasing the stock price per share. Twin tip ski How does a short squeeze work in stock market? During the Great Crisis, Volkswagen became the largest company in the world. After bottoming out, the stock has more than quadrupled, close to its valuation of $400 billion. However, four days before Volkswagen's notable short-term policy tightening, stocks fell four days in a row. How long did the volkswagen short squeeze last time The catch was that Porsche owned 43% of the VW stock, 32% of the stock options and the state. At the end of 2008, short positions increased significantly. Hedge funds saw this and found the stocks were highly overvalued and began to short, hoping they would eventually fall. This may have been the first use of the term "infinite compression". Since then, the short-lived contraction of Volkswagen AG shares in October 2008 has been called 'the mother of all woes'. When did the Volkswagen Infinity squeeze take place? Then, in the midst of the worst financial crisis since the Great Depression, Volkswagen's stock price fell $1,005 (equivalent to $1,258 for my American friends). Porsche won the 2008 Volkswagen Short Squeeze competition. What was the value of the Volkswagen short squeeze? Why did the VW stock rally in 2008?The rally was initially sparked by the surprising announcement that Porsche had increased its stake in VW by closing …

But even in October 2008, short-term interest rates didn't seem too high. What was the short interest in VW in 2008? Short-term interest in Volkswagen At the end of 2008, it could be stated that the short-term interest in Volkswagen was increasing. Most hedge funds held out and were rewarded with a 70% discount just a month after Volkswagen tightened its policy. Interestingly, though, the compression didn't stop. Hedge funds lost about $30 billion when Porsche went bankrupt. How much did hedge funds lose in the Volkswagen squeeze? It was the 2008 Volkswagen Short Squeeze. What was the greatest pressure in history? In 2008 the world markets experienced the strongest absolute contraction ever. What was the biggest short squeeze in history? These principles are reflected in the VW Squeeze and GameStop Squeeze shorts. In addition, any stock or index with a high short-term interest rate has two crucial characteristics. Whatever definition you use, the basics are the same. Is the VW short squeeze the same as the GameStop short squeeze?

For the most part, Volkswagen's short-lived contraction lasted just four days, after which its shares fell 58% from its peak.

How long did the Volkswagen short squeeze last? Most hedge funds held up and were rewarded with a 70% drop just a month after Volkswagen adjusted.

0 kommentar(er)

0 kommentar(er)